Maximizing Financial Recovery: The Cash Home Sale Guide

Selling a home for cash can be a smart way to quickly recover financially. This method offers several benefits, including a faster closing process and fewer complications compared to traditional sales. Homeowners can avoid the hassles of repairs, inspections, and waiting for buyer financing. Cash sales often mean fewer fees and a straightforward transaction, which can be crucial for those needing immediate funds. Understanding the steps and knowing what to expect can help homeowners make the most of this opportunity.

Understanding the Value of Cash Sales in Financial Recovery

When faced with financial hardship, accessing quick funds becomes a priority for many individuals. One effective strategy for achieving this is through the sale of real estate assets, particularly selling your home for cash. This approach offers several benefits essential for quick financial recovery.

Quick Access to Cash for Resolving Immediate Financial Burdens

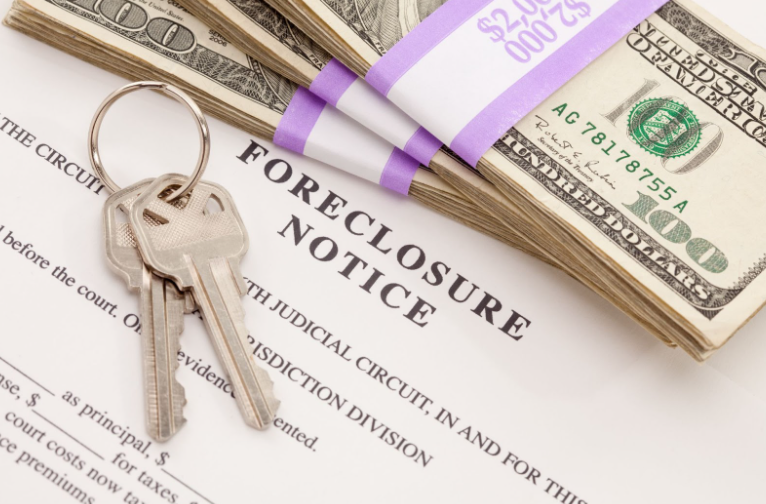

The primary advantage of cash sales in a financial recovery context is the speed of transaction completion. Traditional real estate sales involve multiple stages, including listing, staging, showing the home to potential buyers, negotiations, and the closing process, which can take several months. A cash sale, on the other hand, can often be completed within a few weeks, or even days in some cases. This rapid turnaround is crucial for individuals who need immediate funds to settle debts, and medical bills, or avoid foreclosure.

Avoiding the Drawbacks of Traditional Real Estate Transactions

Cash sales mitigate many concerns associated with traditional real estate transactions. Sellers are not required to pay for costly repairs or renovations to make the home more appealing. There are no real estate agent commissions or fees, which can sometimes amount to a significant portion of the sale proceeds. Cash transactions eliminate the buyer’s financing fall-through risk, a common issue in traditional sales that can cause significant delays or even transaction failure.

Real-life Scenarios Where Cash Sales Facilitated Financial Recovery

Montana-based stories highlight the effectiveness of cash home sales in providing financial relief. For instance, a family in Billings faced with sudden unemployment turned to a cash home buyer, enabling them to cover living expenses and relocate to a more affordable residence without the burden of mortgage debt. Another example is a retired couple in Bozeman who sold their property for cash to settle outstanding medical debts and downsize to a more manageable living situation, significantly reducing their financial stress.

In these scenarios, the ability to quickly liquidate real estate assets for cash was instrumental in the homeowners’ financial recovery. The process not only provided them with the necessary funds to address immediate financial burdens but also allowed them to move forward with less debt and more flexibility.

Understanding the strategic value of cash home sales is the first step towards leveraging your real estate assets for financial recovery. This knowledge empowers homeowners to make informed decisions that can lead to quicker relief from financial hardships.

The Process of Selling Your Home for Cash

The path to financial recovery via a cash home sale encompasses several critical steps, from the initial assessment of your property’s value to the final closing of the deal. Understanding this process is key to a smooth and efficient sale that meets your financial recovery needs.

Initial Assessment: Determining the Worth of Your Home in a Cash Sale

The first step in a cash sale is determining your home's market value. Unlike traditional sales, cash sales often do not require formal appraisals, which can save time and money. It's essential to have a realistic understanding of your home’s worth. Research local real estate listings or use online valuation tools as a reference. Some cash buyers or investor groups may offer a valuation as part of their buying proposal, but having your own estimate ensures you are entering negotiations well-informed.

Engaging with a Professional Cash Buyer: What to Look for and Questions to Ask

Choosing the right cash buyer is crucial. Look for reputable buyers or companies with proven track records. They should be transparent about their process and willing to provide testimonials or references. Key questions to ask include their experience in your local market, the typical timeline for a sale, and any fees or costs you might be liable for. A reputable buyer will be upfront and clear, ensuring there are no surprises.

Closing the Deal: Understanding the Timeline and What to Expect at Closing

One of the advantages of cash sales is the expedited closing process. Since there are no mortgage approvals involved, closing can occur in as little as a week after accepting an offer. Prepare for closing by gathering the necessary documents, such as your property deed and settlement statement. The buyer typically covers most closing costs, but verify this in advance. At closing, you’ll sign the legal documents and receive the sale proceeds.

Case Studies: Examples of Successful Cash Sales and Their Impact on Financial Recovery

Consider the case of Sarah, a homeowner in Denver who quickly sold her house to a cash buyer after her husband's job loss. The swift sale enabled them to pay off their debts and relocate without the pressure of a looming mortgage. Similarly, John, a Florida resident, utilized a cash sale to avoid foreclosure, preserving his credit score and providing a fresh financial start. These stories underscore the transformative potential of cash sales for those in financial distress.

Navigating a cash home sale efficiently can offer a lifeline during financial hardship. By thoroughly understanding each step of this process, homeowners can expedite their recovery, moving towards a more secure financial future.

Planning Your Financial Future Post-Home Sale

After successfully selling your home for cash and stepping onto the path of financial recovery, it’s essential to strategize your next moves carefully. The influx of a substantial sum from a home sale can be both a blessing and a daunting challenge. Wise management of these funds is crucial in rebuilding a stable financial foundation and preventing future hardships.

Reinvesting the Proceeds: Strategies for Reestablishing a Solid Financial Foundation

The immediate inclination might be to use this cash to pay off outstanding debts or loans, which is often a prudent starting point. Prioritizing high-interest debts can help reduce financial strain more effectively. Equally important is considering longer-term investments that can offer continuous returns or income, such as retirement accounts, stock market investments, or even purchasing a more affordable property to reduce living costs.

Managing Post-Sale Liquidity: The Importance of Budgeting After Receiving a Lump Sum of Cash

Receiving a large amount of money at once can lead to impulsive spending if not carefully managed. Creating a budget that accounts for your immediate needs, savings goals, and investment plans can help ensure the longevity of your financial well-being. Tools and apps designed for budgeting can be particularly useful in keeping track of your expenditures and savings objectives.

Long-term Financial Planning: Setting Goals for the Future to Avoid Recurring Financial Setbacks

Post-cash sale is an opportune time to reassess financial goals and make long-term plans. This may include setting aside funds for emergencies, planning for retirement, or saving for education. Consulting with a financial planner can provide professional guidance tailored to your specific situation, helping create a balanced strategy that covers both immediate needs and future aspirations.

Resources and Professional Help: Seeking Advice from Financial Planners and Leveraging Community Resources

Navigating post-sale financial planning can be complex, making it beneficial to seek advice from financial experts. Financial planners can offer insights into investment opportunities, tax implications, and strategies for debt management. Many communities offer resources for financial education and planning, which can be valuable in making informed decisions.

Maintaining Fiscal Stability: Lessons Learned from Cash Sales

Real-life examples have shown that individuals who approach the post-sale period with caution and strategic planning often find longer-term financial stability easier to achieve. The key takeaway is the importance of prudent investment and controlled spending. Sustaining a lifestyle that is within or below your means can prevent the recurrence of financial distress.

By taking these steps, individuals can not only recover from their immediate financial challenges but also build a more secure and prosperous future. The journey towards financial recovery and stability requires discipline, planning, and informed decision-making, especially after the liquidity event of a home cash sale.

Leveraging a home cash sale for financial recovery opens up a unique opportunity to reset one’s financial trajectory. With careful planning, disciplined budgeting, and strategic investments, individuals can navigate their way to fiscal stability and security.

Ready to sell your home fast and get top cash?

Contact Billings Home Buyers today and take the first step toward your financial recovery.